In today’s competitive financial landscape, efficiently managing client relationships is paramount for success. Financial advisors need robust tools to streamline their operations, nurture client relationships, and ultimately, grow their business. This is where Customer Relationship Management (CRM) software steps in. This comprehensive guide explores the vital role of CRM software for financial advisors, detailing its features, benefits, and considerations for choosing the right solution.

We’ll delve into key functionalities, integration capabilities, and address frequently asked questions to help you make an informed decision.

Understanding the Needs of Financial Advisors

Financial advisors face unique challenges. They juggle multiple clients, diverse investment portfolios, regulatory compliance, and the constant need to build and maintain strong client relationships. A CRM system tailored to their specific needs can significantly improve efficiency and profitability. Key aspects that a financial advisor CRM should address include:

Client Relationship Management:

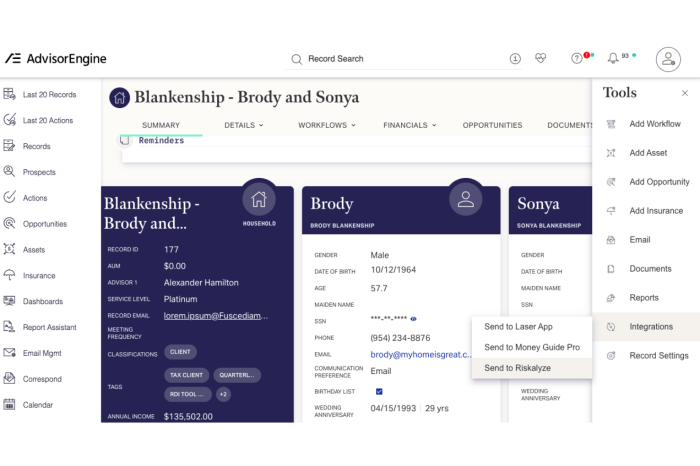

- Centralized Client Database: Access to a single, unified view of each client, including contact information, investment holdings, financial goals, and communication history.

- Client Communication Tracking: Record and track all interactions, from emails and phone calls to meetings and documents, ensuring consistent and personalized communication.

- Client Segmentation and Targeting: Group clients based on shared characteristics (e.g., age, net worth, investment strategy) to personalize marketing and communication efforts.

- Lead Management: Capture and nurture leads through various channels, effectively managing the sales pipeline from initial contact to conversion.

Operational Efficiency:

- Task and Appointment Scheduling: Automate scheduling, reminders, and follow-ups, ensuring timely communication and minimizing missed opportunities.

- Document Management: Securely store and access important client documents, ensuring compliance and facilitating quick retrieval.

- Workflow Automation: Automate repetitive tasks like email marketing, reporting, and data entry, freeing up time for higher-value activities.

- Reporting and Analytics: Gain insights into client behavior, performance metrics, and sales trends to inform strategic decisions.

Regulatory Compliance:

- Data Security and Privacy: Ensure compliance with relevant regulations (e.g., GDPR, CCPA) by employing robust security measures and data encryption.

- Audit Trails: Maintain detailed records of all client interactions and data modifications for compliance audits.

- Access Control: Implement role-based access control to protect sensitive client information.

Key Features of a CRM for Financial Advisors

While the core functionalities remain similar across different CRM systems, some features are particularly crucial for financial advisors. These include:

Investment Portfolio Tracking:

The ability to track client investment portfolios within the CRM, providing a holistic view of their financial holdings.

Financial Planning Tools:

Integration with financial planning software to streamline the planning process and provide comprehensive financial advice.

Compliance Features:

Built-in features to ensure compliance with relevant regulations and maintain accurate records.

Client Portal:

A secure online portal for clients to access their information, documents, and communicate with the advisor.

Source: founderjar.com

Integration with Other Systems:, Crm software for financial advisors

Seamless integration with other essential tools, such as accounting software, email marketing platforms, and financial planning applications.

Choosing the Right CRM Software

Selecting the appropriate CRM software requires careful consideration of several factors:

Budget:

CRM solutions range in price from affordable cloud-based options to expensive enterprise-level systems. Determine your budget and choose a solution that aligns with your financial capabilities.

Scalability:

Consider your future growth and choose a CRM that can scale to accommodate your expanding client base and operational needs.

Ease of Use:

Select a user-friendly system that is intuitive and easy for your team to learn and use effectively. Look for systems with excellent training and support resources.

Integration Capabilities:

Ensure the CRM integrates seamlessly with your existing software and tools to avoid data silos and streamline workflows.

Security and Compliance:

Prioritize a CRM that meets industry security standards and ensures compliance with relevant regulations.

Frequently Asked Questions (FAQ)

- Q: What is the cost of CRM software for financial advisors? A: The cost varies significantly depending on the features, scalability, and vendor. Some offer subscription-based models, while others charge a one-time fee. Expect to pay anywhere from a few hundred dollars per month to several thousand dollars per year.

- Q: How long does it take to implement a CRM? A: Implementation time depends on the complexity of the system and the size of your firm. It can range from a few weeks to several months. Proper planning and training are crucial for a smooth transition.

- Q: What are the benefits of using a CRM for financial advisors? A: Benefits include improved client relationships, increased efficiency, enhanced productivity, better compliance, and ultimately, business growth.

- Q: Can I integrate my CRM with my existing financial planning software? A: Many CRMs offer integration capabilities with popular financial planning software. Check the specific integrations offered by the CRM vendor.

- Q: What security measures should I look for in a CRM? A: Look for features such as data encryption, access control, regular security updates, and compliance with industry standards like SOC 2.

Top CRM Software Options for Financial Advisors

(Note: This section would list specific CRM software options with brief descriptions. Due to the dynamic nature of the software market and potential for bias, specific recommendations are omitted here. Research current market leaders independently.)

Conclusion: Crm Software For Financial Advisors

Implementing a robust CRM system is a strategic investment for financial advisors seeking to enhance client relationships, improve operational efficiency, and drive business growth. By carefully considering your specific needs and choosing the right solution, you can unlock the full potential of your practice and achieve lasting success. Remember to prioritize features that support client communication, operational efficiency, and regulatory compliance.

Thorough research and a well-defined implementation plan are crucial for maximizing the return on your investment.

Call to Action

Ready to transform your financial advisory practice? Explore different CRM solutions today and discover how the right technology can help you achieve your business goals. Contact us for a free consultation!

Questions and Answers

What are the key features to look for in CRM software for financial advisors?

Key features include secure client data storage, robust reporting and analytics capabilities, integration with other financial tools, client communication tools (email, messaging), task and appointment scheduling, and compliance features.

Source: revopsteam.com

How much does CRM software for financial advisors typically cost?

Pricing varies greatly depending on the features, scalability, and vendor. Expect to find options ranging from affordable monthly subscriptions to more comprehensive enterprise solutions with higher price tags. Free trials and demos are often available.

What is the best way to integrate CRM software with existing financial planning tools?

Many CRMs offer direct integrations with popular financial planning software. Check for API compatibility and look for vendors that provide clear documentation and support for integration processes. Consider consulting with a technology specialist if needed.

Is CRM software secure and compliant with industry regulations?

Source: softwareglimpse.com

Reputable CRM providers prioritize data security and compliance with regulations like GDPR and CCPA. Look for vendors with robust security protocols, data encryption, and documented compliance certifications.